Investing in real estate online through crowdfunding gives investors a wide variety of options and possibilities for investments. The types of properties they can invest in are no exception. There are many categories of real estate in which investors can put their money. Each type has its own specific advantages and disadvantages.

Most real estate crowdfunding platforms make it easier for investors by offering only the most promising projects evaluated by their experts or by an independent third party. That way, the investors themselves don't have to study the property type and other specifics too deeply.

However, having basic knowledge about real estate types allows investors to better understand the whole market and further reduce their risk. Also, in some cases, investors simply want to choose a specific property type to fit their investment strategy or to diversify their portfolio.

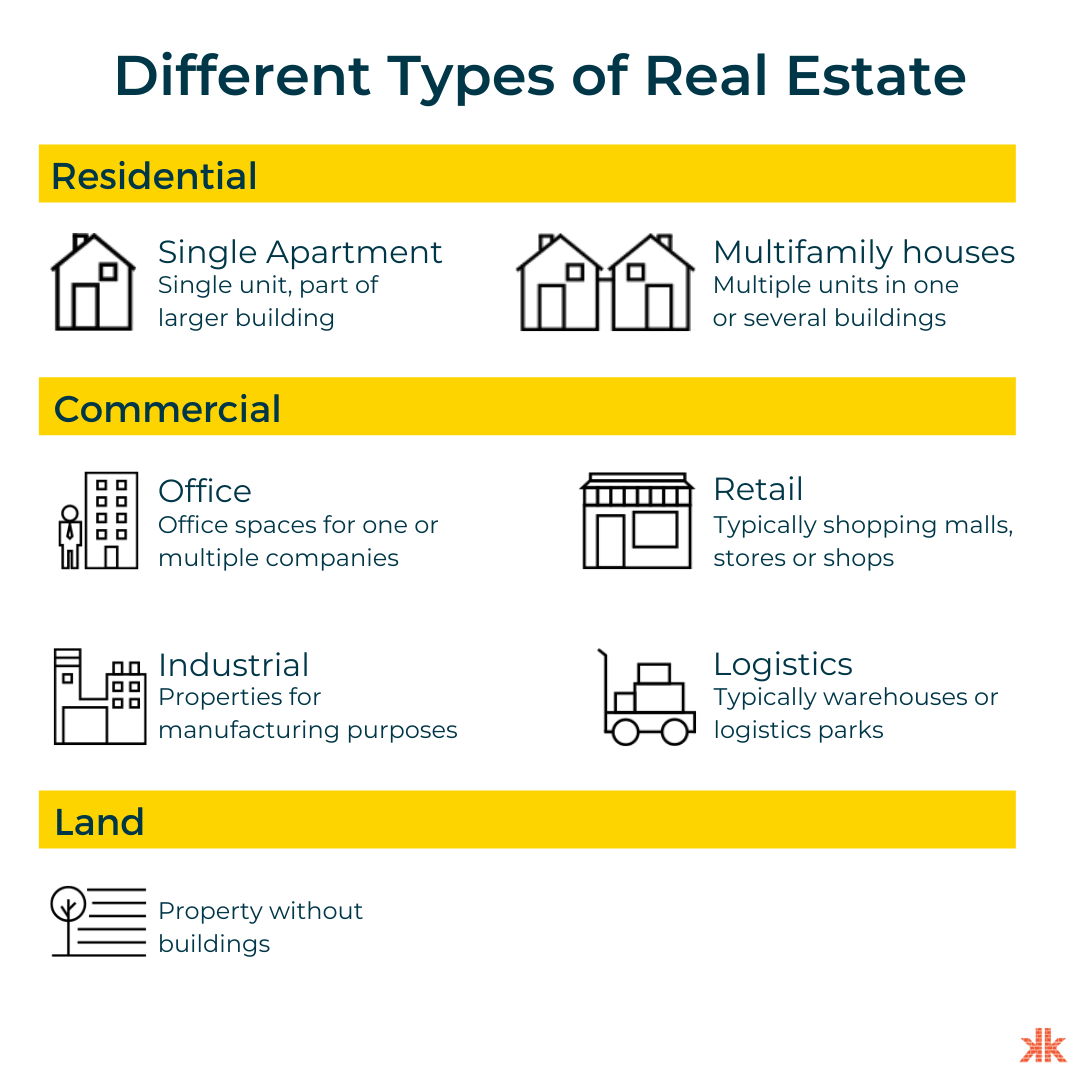

The first thing to understand about the different types of real estate is the 3 major types of properties. These are Residential, Commercial, and Land.

Multi-Family homes in Santa Monica, US

To learn more about real estate crowdfunding, download your free eBook today and receive the tips, insights, and market trends that can help you make the most out of your investments.

Residential properties

Residential real estate involves new developments and existing properties that are meant for people to live in. Nowadays most residential projects are new developments. These projects are usually debt-based, in which case developers are funding them through loans.

The most common residential properties are:

- Single Apartment/Condominium - a single unit that is a part of a larger building with other units.

- Single-Family Housing - a single-family home is a separate building with open space on all four sides that is not attached to any other structure.

- Multi-Family Housing - a type of housing where multiple housing units are contained within one building or several buildings within one complex. A common example of this type of property would be an apartment building.

(Note: multi-family homes with more than 4 units can be considered commercial property, although this varies from country to country)

The least common residential properties are:

- Mobile homes

- Residential caravans

- Houseboats

Office buildings are a common type of CRE

Commercial properties

Commercial real estate, also known as CRE, is primarily occupied by businesses, and the tenants of the property are usually using it for work rather than to live. Commercial real estate crowdfunding investments are typically equity-based, where the main source of income for investors is through capital gains or rental income.

Capital for CRE projects can be raised using multiple funding sources. The main source of funding is generally a combination of loans, while banks often cover 50 - 70% of the project financing needs. The remaining part needs to be financed by the developer’s own equity, which is typically the most expensive source of financing. This means that many developers are frequently searching for alternatives. This is where real estate crowdfunding investors can step in and provide the needed financing for the project.

The main types of commercial real estate are:

- Office - A building containing office space for one or multiple companies.

- Retail - Retail properties include buildings such as shopping malls, retail stores, or shops.

- Industrial - Properties for manufacturing purposes such as plants and factories.

- Logistic complexes - With the rise of e-commerce over the years, there has been an increasing demand for logistic properties. This type includes warehouses, distribution facilities, fulfillment centers, and logistics parks.

- Mixed-use - In these cases, the building serves both purposes, residential and commercial. A typical example would be a storefront property. Mixed-use properties offer a great diversification option within one project.

Land

Land can be used for many purposes, including both residential and commercial developments. Land can be defined as real estate or property without any buildings, structures, or equipment on it. Most land properties are bought to start a new development or in the hope that the property will appreciate over time and thus sold for a higher price in the future.

“Buy land, they're not making it anymore” (Mark Twain)

Learn more about real estate crowdfunding terms in our glossary!